Staying the Course through the Coronavirus Sell-Off

The spread of COVID-19 (more commonly known as coronavirus) is dominating media coverage and roiling global financial markets.

The spread of COVID-19 (more commonly known as coronavirus) is dominating media coverage and roiling global financial markets.

First and foremost, we urge our clients to be informed about the virus, its symptoms, how it spreads, how to protect oneself, and to dispense with the many circulating misconceptions about the virus. To that effect, below we include a link to the World Health Organization’s website for easy reference:

https://www.who.int/news-room/q-a-detail/q-a-coronaviruses

We are not medical professionals, nor epidemiologists, so we cannot opine on the virus’ spread. What we can speak to however, is our experience navigating moments of market volatility, such as the present. At the time this note was published, the S&P 500 had already entered “correction” territory, meaning a price decline of at least 10% from a prior peak. Since 1945, there have been 26 market corrections (not including the current one), with an average decline of 13.7% for the S&P 500.¹

In these moments, we ask ourselves a few very important questions:

1. Have we been here before?

Yes and no.

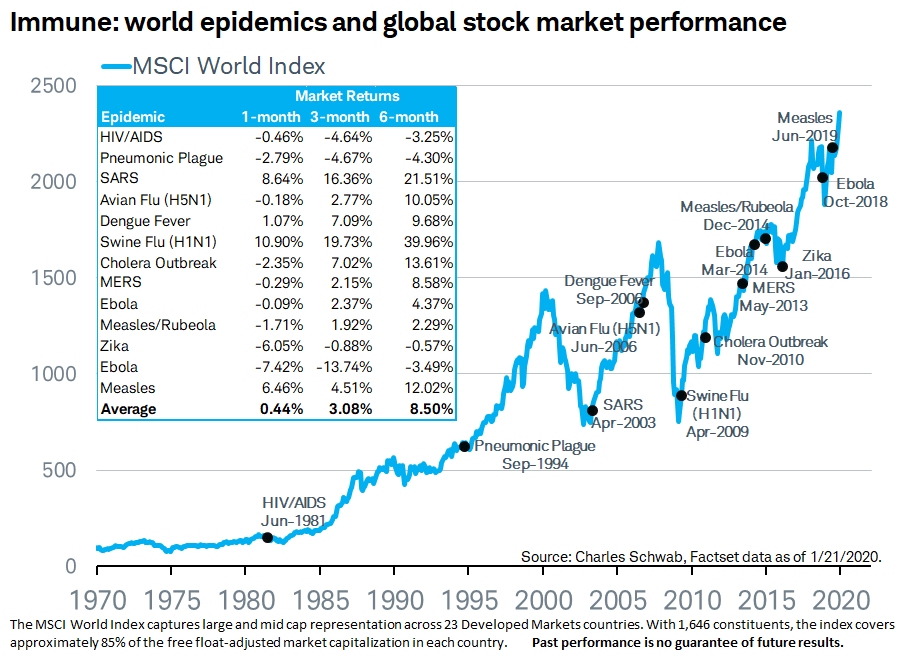

In our increasingly interconnected economy, we have experienced a growing number of global health scares. In just the past two decades, we saw SARS, Avian Flu, Swine Flu, Ebola, and Zika (among others), each one equally frightening at the time. These outbreaks elicited similar panics, but only temporary economic and market impacts.

That said, when past outbreaks erupted, they were more geographically contained. Furthermore, while China was also hit hard during the SARS epidemic, in 2003 the country accounted for only 4% of global GDP; today that number is closer to 16%.

2. What are the implications this time?

Still unclear.

Given the general moratorium on migration within mainland China, it is highly likely that there will be a short-term hit to Chinese economic activity in the first (and possibly second) quarter. Corporations large and small around the world that rely on China for any part of their production process will also feel the impact as orders get backlogged. Furthermore, global tourism may be weak in the next few months as individuals and families weigh the risks of traveling amid an increasing number of infections in Asia and Europe, as well as government-imposed travel bans and quarantines.

Over the longer term, it is still uncertain how the current outbreak will affect the global economy. If the number of cases continues to increase (especially within China), and workers are forced to stay home for months on end, it could mean a more severe hit to global GDP as supply chains are further disrupted and trade-sensitive economies suffer. Alternatively, there is always the possibility that the number of new cases stabilizes and eventually decreases, in which case this may turn out to be just another short-term pullback in a longer-term bull market.

3. Does diversification help in this case?

Yes.

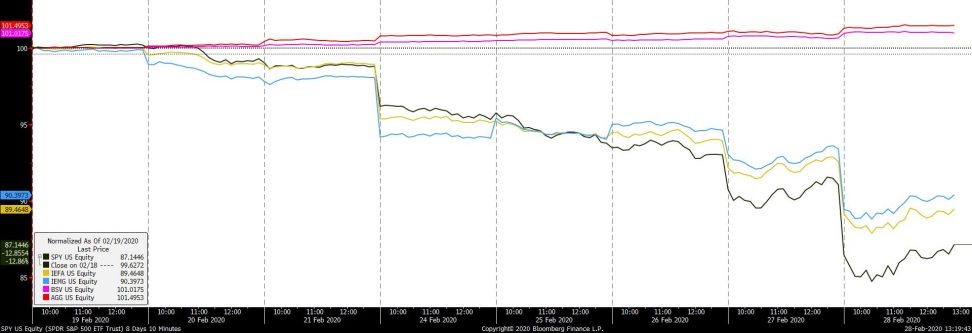

We repeatedly stress the importance of diversifying across market caps, investment styles, geographies, and asset classes because we know there will be corrections, but we cannot know for certain when they will arrive, what will cause them, nor how long they will last.

While in very brief moments (i.e. minutes and hours) various equity markets may move in sync, over the longer term (i.e. days, weeks, and months) correlations between them are not perfect. Furthermore, despite living in the era of extraordinary monetary policy, the negative correlation between equities and investment-grade bonds is holding. These dynamics have been on display in just the last few days:

Since the start of this correction, international equity markets have not sold off as much as the U.S. stock market, and short-term bonds and core fixed income are positive. For this reason, we emphasize the need for broad diversification, and for those clients with liquidity needs to maintain exposure to fixed income, even with interest rates as low as they are.

4. Is the current volatility more extreme than usual?

So far, no.

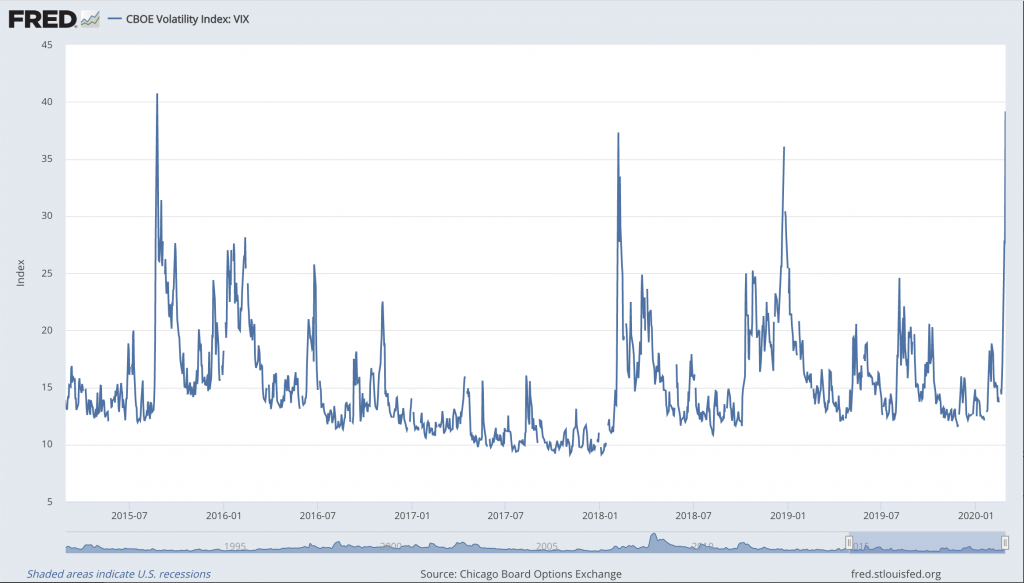

For several years (and for various reasons) market volatility has been subdued relative to its historical average. In fact, during any given year, we would typically expect several declines in excess of 5%, and at least one correction (10%+) every two years. The last correction we experienced was at the end of 2018, a decline of nearly 20% for the S&P 500.

Market volatility, as measured by the VIX Index, started off the year extremely low, but has risen this week to levels witnessed twice in 2018 and once in 2015.

It is important to remember that as equity markets decline in the short term, it provides opportunities to buy shares of quality companies at more attractive valuations.

5. What should we do right now?

Stay the course.

For clients that are fully invested, we are following our discipline. Equities are long-term investments and we are not going to sell right now. In fact, leading up to this current correction, we had been gradually reducing equity exposure, bringing most client portfolios back to their long-term, “neutral” asset allocation targets.

For clients with available cash, we are being prudent and waiting for markets to stabilize before deploying it. Even within fixed income we are cautious about investing fresh cash, as the equity market rout has pushed bond yields to all-time lows.

If you have any upcoming liquidity needs, please make sure we are aware so that we may factor them into our management of your portfolio.

As always, we are closely monitoring the situation, and are here to address any questions or concerns you may have about your portfolio or the markets in general. Please do not hesitate to reach out to us at +1 (301) 881-3727.

¹ Goldman Sachs