Q3 2024 Insights

A wise woman and longtime friend to SOL Capital said on the evening after the election back in 2016 (and we are paraphrasing) that if you are happy with the results, it is not going to be as good as you think and if you are upset with the results, it will not be as bad as you fear. Eight years later, one can agree or disagree with that statement, but at the end of the day as investors, our focus must be on the state of the markets, the health of the economy, and the business cycle. Politicians certainly can influence all, but in general their effect, whether positive or negative, is muted by many other factors.

This time, U.S. equity markets rallied after the results of the presidential election were clear on hopes that President-elect Trump would push through tax cuts and deregulation. In fact, historically, U.S. markets rally after presidential elections because of decreased political uncertainty. (See Appendix A). The rally continued Thursday after the Federal Reserve cut its federal funds rate by a quarter-percentage point (25 basis points). And then on Friday, the University of Michigan consumer sentiment survey increased more than expected from 70.5 in October to 73.0 in November. The CBOE Market Volatility Index is a popular measure of the stock market’s expectation of volatility based on S&P Index options. It declined substantially from 21.98 on November 4th to levels under 15. All-in, the market appears to be sighing in relief that the election was decisive and that the economy remains on firm footing, further supported by Fed easing.

Non-U.S. markets declined for the same period, however, most of the decline was due to the dollar strengthening. In local currencies, developed markets also rallied and emerging markets were flat.

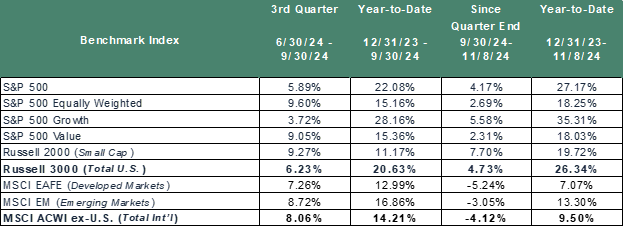

Exhibit 1 – Equity Market Returns Source: FactSet. Performance data presented above is total return (price appreciation plus dividend and/or interest income). Non-U.S. equity benchmark returns are presented net of foreign taxes.

Source: FactSet. Performance data presented above is total return (price appreciation plus dividend and/or interest income). Non-U.S. equity benchmark returns are presented net of foreign taxes.

Fixed income generally declined after the election as yields on the 10-year Treasury rose to 4.479%. Trump campaigned on low taxes and extensive tariffs on imports. Lower taxes would enlarge the federal budget deficit, which is already much higher than it was eight years ago. Additionally, tariffs could lead to higher inflation, which could limit further Fed rate cuts.

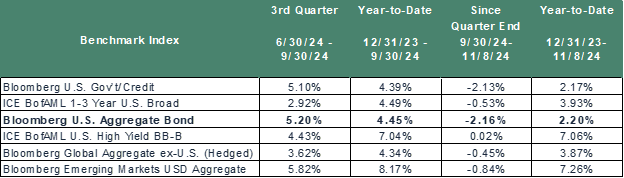

Exhibit 2 – Fixed Income Market Returns

Source: FactSet. Performance data presented above is total return (price appreciation plus dividend and/or interest income).

Source: FactSet. Performance data presented above is total return (price appreciation plus dividend and/or interest income).

Exhibit 2 – Fixed Income Market Returns

Equities

Global equity markets continued to move higher during the third quarter. The Federal Reserve cut interest rates for the first time in over four years and China announced a major stimulus plan. Volatility rose around some uncertainty regarding the path for interest rates and the forthcoming US elections.