Q2 2021 Insights

The continued economic re-opening and successful vaccine distribution in many regions (especially in the U.S.) allowed for a release of pent-up consumer demand. However, global supply lines remain somewhat dislocated because of the pandemic’s disruption and are not quite able to keep up with demand. As a result, inflation numbers continue to make headlines as ordinary consumers grapple with higher prices on energy, real estate, airfare, and used cars. Global financial markets recorded solid returns in the second quarter. Equities continued their broad rally, with some change in leadership, while bond markets began to recover as yields unexpectedly fell.

Asset managers and policymakers alike are debating how persistent this bout of inflation might be. Is it just a byproduct of pent-up demand meeting short-term supply chain bottlenecks, or are we experiencing a return to 1970s-style inflation? Furthermore, the future direction of government spending, stimulus, and tax rates globally pose multiple sources of uncertainty for many market participants. Guessing the outcome of these overhangs may drive investors to overreact, making big changes to their portfolios, and potentially doing more harm than good to their future financial stability.

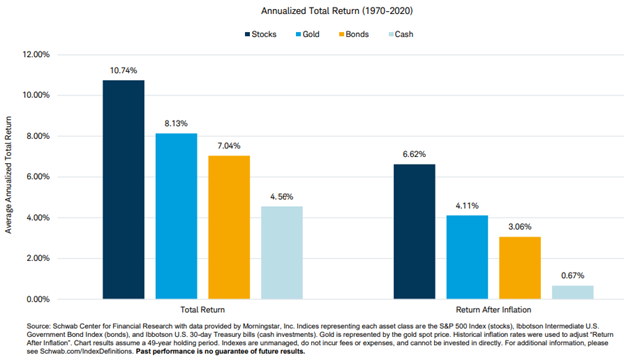

In response to these unknowns, we, as always, urge caution, patience, and discipline. On inflation, we tend to side with the Federal Reserve’s view that the current headline-grabbing price increases should be more transitory in nature, though we do expect marginally higher inflation versus the lackluster levels we witnessed since the Global Financial Crisis. Fortunately, there are a number of ways to protect a portfolio against rising prices that do not require a drastic overweighting towards more volatile alternative assets such as gold and other commodities. A well-diversified portfolio of equities has a proven track record of withstanding sustained inflationary periods (see Appendix A).

Regarding tax rates, we encourage investors to not focus on the worst-case scenario(s) that might circulate through the media. Much time-consuming negotiation and wrangling go into tax legislation, as it is naturally one of (if not) the most politically sensitive. Pre-maturely generating capital gains in the anticipation of higher tax rates could be a dangerous strategy – especially as we approach yet another election year in the United States. In the meantime, there are several tax-efficient strategies we continue to employ when managing taxable portfolios, such as a heavier utilization of exchange-traded funds (ETFs) and tax loss harvesting when available and applicable.

More pressing than these issues is the uncertainty surrounding COVID-19’s Delta variant, which continues its rapid spread around the globe. How national and local governments tackle this threat is of utmost concern to financial markets. Will we witness the re-imposition of social-distancing measures, or instead will there be more of a concerted effort to convince unvaccinated populations to receive their doses, lessen the strain on the health care system, keep most businesses open, and allow the economic recovery to continue?

As investors, it is impossible to time these health crises and policy developments, where short-term outcomes can meaningfully pivot on “man-made” (and ever-evolving) responses by government and society at large. Now is not the time to make portfolios overly aggressive, nor is it the time to become overly conservative. Broad diversification across asset classes, sectors, styles, and geographies, coupled with periodic rebalancing to your strategic, long-term asset allocation target is a time-tested way to navigate uncertainty in markets, politics, and the economy over the long term.

Apendix A: Equities Hedge Against Inflation.