Q&A with our investment team: Managing portfolios for the long term during market volatility

Volatility is how much and how quickly prices move. During periods of elevated market volatility and uncertainty—such as what we are experiencing right now—it is human nature to feel anxious and have questions about what those ups and downs mean for you. To help answer some of the top questions we have been hearing from our clients, we sat down with the SOL Investment Team to glean and share their insights. Our goals with this Q&A are to:

- Help investors and clients navigate these challenging times and avoid financial decisions that may be counterproductive

- Demonstrate the importance of staying disciplined and of investing for the long term

- Highlight how our team manages portfolios for the long term during periods of heightened volatility

To help our clients make sound financial decisions, we invite our clients to call us to discuss their individual portfolio situations if there are questions.

Q1: How does market volatility affect the value of companies in my portfolio?

It is important to remember that, at SOL, our Equity portfolios are long-term investments in companies. Investors invest in companies through share ownership, but long-term investors should see themselves as owners of the business and not just buyers or sellers of shares of stocks.

The intrinsic value, or worth, of these shares will fundamentally fluctuate over time depending on a given company’s ability to operate and produce earnings across different economic conditions. Yet the aggregate behavior of buyers and sellers also affects the price of a company’s shares, causing them to either climb above or slip below their intrinsic value. Overall, then, share price volatility—away from intrinsic value—is driven by many factors, and it is a normal part of investing.

Share price volatility can be even more prominent during periods of high macroeconomic and geopolitical stress (e.g., the Russia-Ukraine war, energy price instability, high inflation, and rising interest rates). During times like these, even best-of-breed companies with strong fundamentals may be unduly punished or oversold by market participants, resulting in significant dislocations between the share price and the intrinsic value of a company.

The upshot? For investors who can appropriately assess the true worth of a company, increased stock market volatility also provides greater opportunity to profit over the longer term.

Q2: How does SOL help manage my investments through volatility?

Again, share price volatility is a normal part of investing. Instead of trying to time market fluctuations, we believe it’s more essential for investors to understand how to avoid behaviors that are counterproductive to their financial goals in the face of volatility. As owners of companies, it’s important to fight the instinct to sell during these times. More beneficially, our team focuses on three key pillars when it comes to managing portfolios through market stress.

- Look for opportunities to buy high-quality companies at steep discounts

For long-term investors, the current environment is ideal for picking up high-quality businesses at low valuations. While broad market indices may still have valuations that are above historical averages, some companies within the indices are trading at steeply discounted and attractive valuations due to negative market psychology and selling. This environment is ripe with opportunities for our active managers to progressively buy increasingly higher-quality companies that are temporarily trading significantly below intrinsic value. - Rebalance and improve portfolio exposures

Prudent investors should exercise discipline and use these periods of temporary dislocations to their advantage by “rebalancing” their portfolios. At SOL, we rebalance carefully and gradually, staying invested in order to mitigate uncertainty from such unknowns as when markets will recover or how long risk factors will persist. Decades of empirical data show that, without a crystal ball, timing the market simply doesn’t work. We seek to capitalize on periods of high volatility and increase portfolio exposures to undervalued and out-of-favor companies, positioning the portfolio to benefit in the long run when markets do eventually recover. In tandem, our approach to rebalancing also means we resist buying overvalued companies during periods of market exuberance. - Stay committed to the “owner-of-the-business” mindset—and be patient

SOL Capital Management is committed to constructing a diversified portfolio of high-quality companies. As owners of the business, before we buy, we look for each company to possess certain longer-term qualities.

Q3: How does SOL define a well-constructed, long-term investment portfolio?

A strong portfolio—one that that gives us confidence and indicates we’re taking prudent action in times of elevated volatility—is characterized by the following:

- Broad diversification

- Emphasis on quality

- Discipline regarding valuations

- Staying the course

- Patience

As ”owners” of a business, it is even more important to retain a long-term view and to stay the course—so long as the business continues to show desirable characteristics.

Q4: Is there a road to recovery in the future?

While past performance may not be indicative of future results, history does provide some reassurance regarding prior market cycles.

As seen in Figure 1, the market—as represented by the S&P 500 Index—has experienced some well-known periods of market volatility over the past century, and each time it eventually recovered. For the patient investor, the market discounts proved to be temporary and the road to portfolio recovery could be potentially quick and sharp, as was the case with the most recent Covid-19 market drawdown in 2020.

Figure 1: Historical S&P 500 Index Total Return Performance

*U.S. large company stock returns, logarithmic values of real monthly average price return

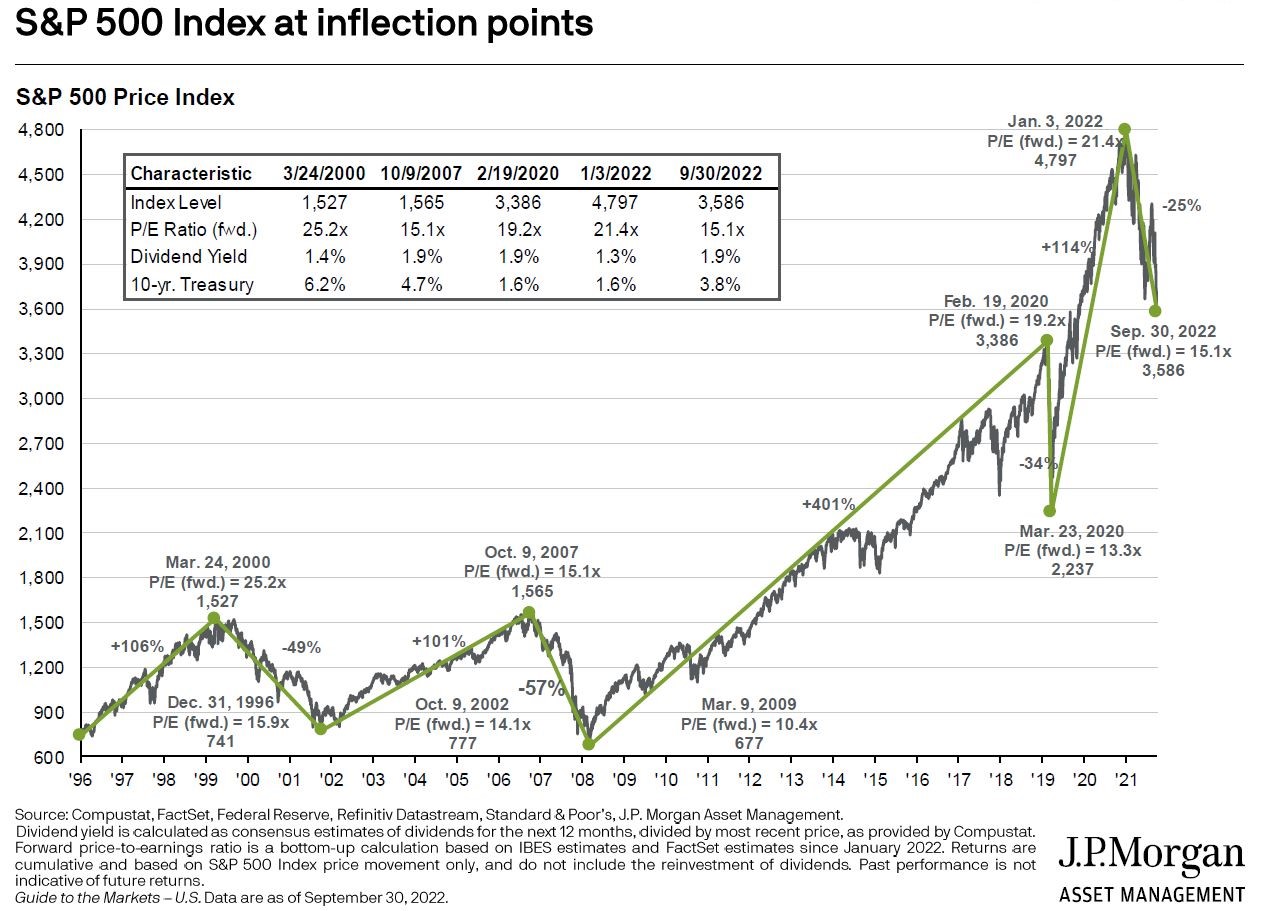

Figure 2 below demonstrates how market fundamentals and characteristics typically shift over various market cycles. Over the past 25 years, the valuation of the S&P 500 Index, as measured by forward P/E multiples, traded as high as 25.2x before the dot-com bubble burst in 2000 and as low as 15.1x after the 2007-2008 financial crisis. Investors who were able to take advantage of the low multiples in that latter period enjoyed a significant recovery over the next 15 years. Note that, at the end of September 2022, the S&P 500 was trading at 15.1x, presenting investors with an opportunity to invest at attractive levels near its 25-year valuation lows.

Figure 2

Putting it all together

Portfolio volatility is a normal part of investing and market timing rarely works out for investors over the long run. At SOL, across all environments, we invest in a well-diversified portfolio comprising high-quality businesses. This approach is our best defense against significant drawdowns, and it positions the portfolio to benefit from various sources of market recovery. Investors will also need to be patient and commit to staying the course for their portfolios to eventually be on the road to recovery.

**Please Remember: Please contact SOL Capital, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently.**