Q4 2017 Insights

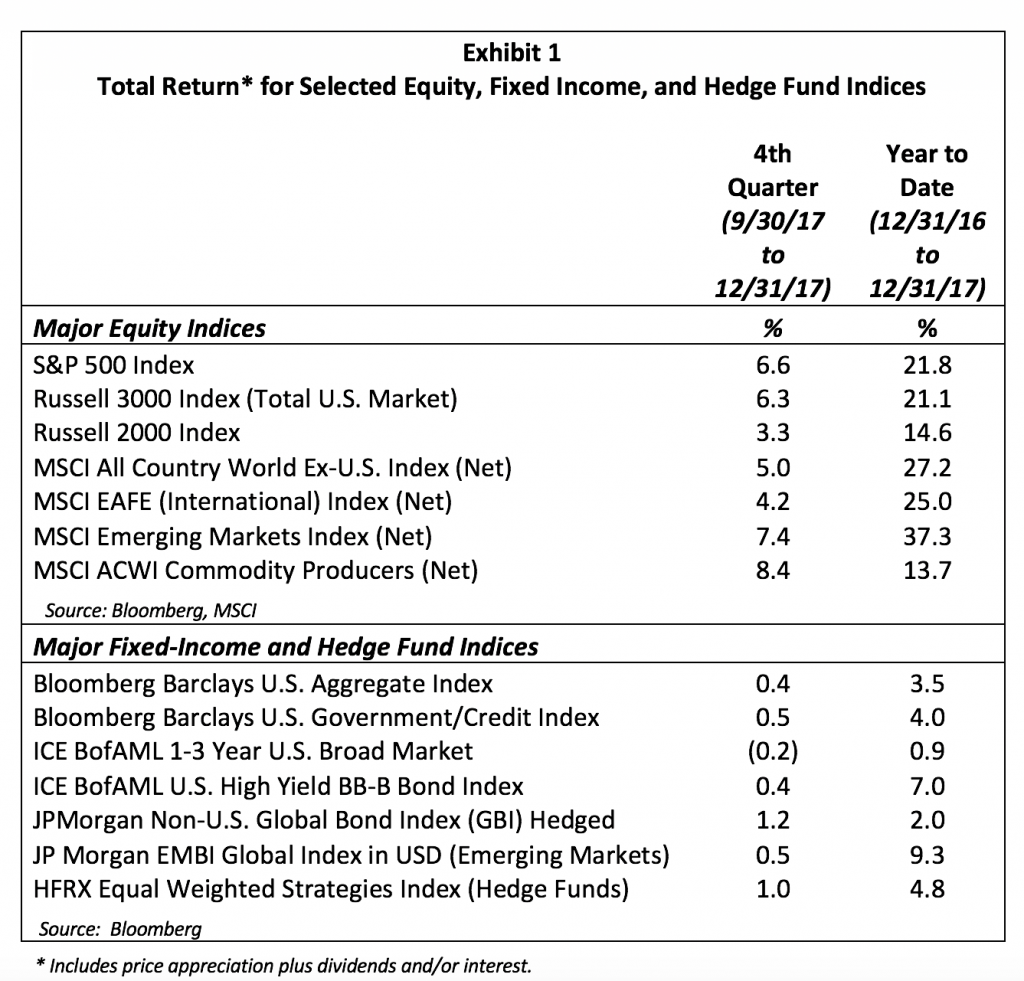

Global equities continued to rally in the fourth quarter, capping a year of strong returns. The S&P 500 Index gained 21.8% in 2017, delivering its best calendar year performance since 2013. Results were even stronger overseas, with the MSCI EAFE Index and the MSCI Emerging Markets Index rising 25.0% and 37.3%, respectively, in U.S. dollar terms (see Exhibit 1). Throughout 2017, global stock markets reached successive new highs, lifted by improving economic indicators, robust corporate profit growth, and abundant liquidity. The prospect of U.S. tax reform, which passed in late December, further boosted investor sentiment. The favorable economic and earnings environment was also supportive of fixed income. Major investment grade and high yield bond indices advanced in the fourth quarter to finish the year with solid gains.

As stock and bond indices rose, volatility was exceptionally low in 2017. The VIX¹ Index , whose long-term average is approximately 20, closed below 10 on 52 trading days in 2017. Globally, the MSCI World Index saw only three days with a movement (up or down) of more than 1% (the 10-year average is 72 days). The lack of volatility was not confined to equity markets. The yield on the 10-year Treasury note traded in its narrowest annual range since 1965.

¹The VIX Index is a measure of market expectations of near-term volatility conveyed by S&P 500 Index option prices.

Despite the relative calm, several events could have disrupted the financial markets. Tensions flared with North Korea, Europe held important elections, and severe hurricanes impacted parts of the United States. However, market participants were undeterred, focusing on the fundamental strength of economies and companies. In addition, central banks generally remained accommodative, and the liquidity provided helped to further suppress volatility.

That being said, investors should not become complacent in this docile environment, but instead prepare for volatility to rise to more normal levels. As this letter goes to press, global markets have just gone through another short-term pullback, something we have not seen since the aftermath of the “Brexit” referendum in mid-2016. However, as markets sold off over the course of a few days, the outlook for corporate earnings did not change; fundamentals remain strong. Nevertheless, while this is not necessarily an omen of a downward trend to come, it may not be the last bout of volatility we witness in the coming year. In 2018, the global shift toward less accommodative monetary policies could unsettle markets (see Appendix A). The Federal Reserve raised interest rates three times in 2017 and, in October, began reducing the size of its balance sheet. Several foreign central banks have now joined the Fed in unwinding crisis-era stimulus, including the European Central Bank, which has extended its bond-buying program, but tapered the amount of monthly purchases.

Whatever its cause, volatility always feels uncomfortable and can be widespread, affecting many asset classes simultaneously. However, it is important to remember that temporary dips in equity markets present opportunities for our managers to pick up shares of quality companies at more attractive prices. So, as we enter the new year, it is important to remember that the best strategy for weathering market choppiness is to maintain discipline by adhering to your long-term investment program. The volatility inherent in equities and higher yielding fixed income is what allows these securities to command a higher return over more stable assets like government bonds. Therefore, investors seeking attractive long-term returns must stay the course during volatile periods. However, if you have any upcoming liquidity needs that you have not shared with us, please let us know so we may structure your portfolio accordingly.

Tax Reform

The U.S. Congress recently passed the most sweeping tax overhaul in decades, affecting both corporate and individual taxpayers. We will soon see its initial effects as paychecks begin to follow new withholding rules, and first quarter earnings are released. However, the full effect of the tax plan will not be realized until early 2019 when tax returns are filed and revised deduction rules are taken into account. Forecasts suggest that tax reform will add a relatively modest 0.2% – 0.5% boost to 2018 domestic GDP growth, due in part to minimal slack in the economy. Tax cuts tend to be more potent during recessions, when the economy operates below its potential (see Appendix B).

Most of the tax relief goes to businesses, as lawmakers cut the corporate tax rate from 35% to 21%, bringing the United States more in line with other developed economies. However, it is unclear how specific industries and companies will be affected. Broadly speaking, companies with mainly domestic operations and revenue should benefit more than multinational companies whose international operations have kept their effective tax rates low. Furthermore, the tax bill also includes changes to deductions and credits that will impact businesses in different ways. Smaller businesses and closely-held companies (S-Corps, LLCs, and LPs), especially those operating in high tax states may not share the same relief granted to large (C-Corp) corporations. Adding to the uncertainty, it is unclear how companies will use their additional profits. Will they increase capital spending, raise wages, retire debt, repurchase stock, increase dividends, or engage in a combination of these and other activities?

With respect to individuals, while lower personal tax rates may increase consumer spending, the relative boost to the economy will depend on various consumers’ propensity to spend additional income on goods and services, save and invest, or pay down debt. In addition, residents of high tax states, such as California and New York, may not realize any tax savings due to the new limit on the deductibility of state and local income and property taxes.

Fortunately for investors, the final tax bill did not include a restrictive “first-in, first-out” accounting rule, which would have eliminated the ability to choose the specific shares to sell when reducing or liquidating a position. All said, the long-term impact of tax reform is still unknown, and is merely one of many variables we consider in our investment process.

Financial Markets & Performance

Equities

The U.S. stock market continued to perform well in the fourth quarter, adding to the year’s robust gains (see Exhibit 1). The strength in domestic equities was broad based, with all major market capitalization ranges, style segments, and economic sectors generating positive returns.

On a comparative basis, the large-cap S&P 500 Index outperformed the small-cap Russell 2000 Index in the fourth quarter. Several factors limited investors’ enthusiasm for small-cap stocks: the short-term effects of tax reform are uncertain, even though small companies are expected to benefit disproportionately; small-cap stocks are already trading at expensive valuations; and smaller-cap companies typically issue more floating rate debt than larger companies, the cost of which has increased markedly in recent months.

Large-cap equities also led small-cap equities for the full year, supported by their earnings power, as well as their ability to fund dividends and other shareholder-friendly actions on a sustained basis. Broad weakness in the U.S. dollar also provided a lift to the earnings of large multinational corporations.

Throughout 2017, the growth segment of the U.S. stock market continued to outperform value across market capitalization ranges. As growth stocks are less reliant on the relative pace of economic growth to increase earnings, they benefited from the ongoing, slow-growth environment. As one would expect, growth-oriented sectors, such as technology and consumer discretionary, were among the best-performing in the S&P 500 Index for the quarter and the year. That said, value-oriented financials and industrials also performed well in both periods. Rising U.S. interest rates and the rollback of regulations bolstered financials, while the prospect of reduced regulation helped industrials. In contrast, defensive areas of the market generally lagged. Utility stocks made up the worst-performing sector in the fourth quarter, and telecommunication services finished in last place for the year.

International equities trailed the broad U.S. stock market during the quarter, despite the tailwind of a weaker U.S. dollar. Recent events in developed Europe contributed to the underperformance, as political uncertainty weighed on stock prices in Germany, Spain, and Italy. In contrast, developed and emerging Asian markets (including Japan and South Korea) generally posted outsized gains. Japanese equities benefited from Prime Minister Abe’s decisive victory in a snap election, breathing new life into his pro-growth agenda. South Korea’s strong performance was largely driven by surging appreciation in the won amid central bank tightening and robust foreign demand for the country’s semiconductor stocks. For the full year, international equities outperformed domestic equities by a substantial margin.

Fixed Income

Steady economic growth, rising corporate profits, and muted inflation contributed to positive returns across the global bond markets throughout 2017. The broadest measure of domestic fixed income performance, the Bloomberg Barclays U.S. Aggregate Index, posted a 0.4% increase in the fourth quarter to end the year with a 3.5% return, representing the Index’s strongest annual gain since 2014.

During the fourth quarter, the Fed’s monetary tightening pushed yields on short- and intermediate-term U.S. Treasury securities higher, while yields on long-term Treasuries were stable. Overall, the U.S. Treasury market posted flat returns. Sovereign debt markets in other developed countries generally outperformed the U.S. Treasury market. However, gains were subdued, reflecting the global trend toward less accommodative central bank policies.

In the investment grade corporate bond market, U.S. securities finished the quarter in positive territory across credit qualities, delivering excess returns over Treasuries. U.K. corporate bonds benefited from their relatively long duration, as U.K. government bond yields declined. Eurozone investment grade fixed income also managed positive returns. A widening in credit spreads² limited gains in U.S. and European high yield corporate debt, although U.S. spreads had recovered by year-end. In emerging markets, U.S. dollar-denominated government and corporate bonds, as well as local currency issues, built on the strong gains they had posted in the prior nine months.

² A credit spread is the difference in yield between a government bond and a debt security with the same maturity, but of lesser quality.

Global Economic Outlook

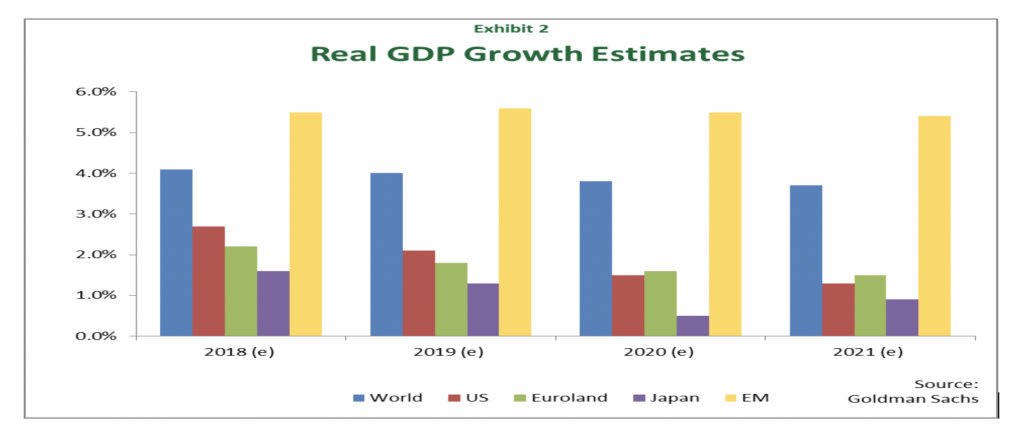

2017 was characterized by a favorable combination of low inflation, synchronized economic expansion, and generally accommodative monetary policies. Over the next few years, we expect growth to gradually moderate in China and other major economies as policymakers tighten financial conditions responding to simmering price pressures. Additionally, tight labor markets in a number of developed countries could spur wage inflation. However, even if economic fundamentals going forward are less ideal than they were in 2017, we believe the environment remains promising for continued global growth for the foreseeable future (see Exhibit 2).

United States

Now in its ninth year of expansion, the U.S. economy is showing signs it is entering the more mature phase of the business cycle. Corporate profits are growing at a healthy pace, but profits margins have declined from peak levels. Unemployment is at a 17-year low, wage growth is firming (see Appendix C), and the Fed is tightening monetary policy.

Despite exhibiting these late-cycle dynamics, the economy appears on track to accelerate modestly in 2018 after growing 2.3% in 2017. Hurricane-related spending should have a positive near-term impact, and fiscal stimulus from the new tax legislation should provide a modest boost to the economy, however the timing of the tax legislation may prove problematic. Typically, the government does not ease fiscal policy when labor market conditions are tight, economic output is close to capacity, and the Fed is reducing liquidity. If fiscal stimulus stokes inflation, the Fed may be forced to hike interest rates more aggressively than the three 0.25% increases projected for 2018, which would dampen the effects of the new tax law.

Europe and Japan

The eurozone economy continues to enjoy a mid-cycle expansion, driven by domestic consumption and underpinned by the lowest level of unemployment since 2009. Furthermore, business and consumer confidence are at multi-year highs, demand for credit is strong (see Appendix D), and core inflation³ has been steadily rising. Nevertheless, there are still risks on the continent. In Spain, Catalonia’s push for independence will likely create ongoing tensions between Barcelona and Madrid, however we do not believe it will jeopardize Spain’s relatively strong economic growth. Upcoming general elections in Italy may be a bigger issue for the region, as the anti-Europe, anti-establishment Five Star Movement was leading the polls at year-end, although it is likely a coalition of centrist parties will ultimately prevail. Perhaps most importantly, we are awaiting the conclusion of protracted coalition negotiations in Germany that will ultimately determine the level of Angela Merkel’s political clout for her fourth term as Chancellor.

In the U.K., the June 2016 Brexit vote to leave the European Union (EU) continues to adversely affect the economy. GDP grew at its slowest pace in five years in 2017, and growth is expected to remain weak as Britain renegotiates its economic ties to the EU and the rest of the world. The uncertainty surrounding Brexit has discouraged investment and immigration, leading to weakness in the British pound. As a result, even though the economy is sluggish, the U.K. is experiencing higher inflation, which has forced the Bank of England to raise interest rates for the first time in 10 years.

Japan is enjoying its longest period of uninterrupted growth in 16 years, driven by strong global trade amid record exports to other Asian markets. A gradual decline in unemployment and signs of wage inflation (see Appendix E) suggest that domestic consumption could accelerate. Nonetheless, the outlook for growth and inflation remains subdued, and despite speculation to the contrary, the Bank of Japan has indicated it is not ready to join other central banks in unwinding stimulus.

³Core inflation is a measure of underlying inflation that eliminates volatile food and energy prices.

Emerging Markets

In 2017, China’s economy accelerated for the first time since 2010, expanding 6.9%. Growth is likely to slow modestly over the next several years given steps policymakers have taken to rein in rising private sector debt (see Appendix F), including raising banks’ borrowing costs and reducing fiscal spending. That said, China’s economy is still set to grow at a very healthy rate, driven by domestic consumption, now representing nearly two-thirds of total output.

India appears on track for even faster growth than China, both in 2018 and beyond. Rising food and housing prices caused inflation to pick up a few months ago, but has since stabilized. Growth in urban areas is robust, and the government has increased spending on a variety of programs designed to stimulate economic development in rural areas.

Latin American economies are expected to grow at a solid rate, although subdued when compared to emerging Asia. In Mexico, the contentious NAFTA renegotiations have led businesses to scale back and postpone investment, and the outlook for domestic demand is declining, as high inflation erodes wage increases. The polarizing July presidential election also adds to the uncertain environment. In Brazil, sweeping corruption investigations and trials continue to upend politics as usual. The country also faces pivotal elections in 2018, just as its economic recovery is starting to strengthen and broaden. The job market has improved, loan growth is poised to accelerate, and falling inflation has allowed the central bank to aggressively ease policy.

Investment Strategy

Equities

Corporate profits began to rebound globally in early 2017 and have since broadly exceeded consensus expectations. This development has propelled the S&P 500 Index and other stock market indices to record highs, leaving valuations at or above long-term averages (see Appendix G). Consequently, we have been rebalancing portfolios to decrease equity exposure and more closely align client portfolio asset allocations with their long-term strategic targets. As we reduce exposure to more overvalued assets, we reinvest in fixed income and cash equivalents and/or in undervalued equities (e.g., U.S. value, international, and emerging markets), as appropriate. However, should near-term volatility subside and the strong upward momentum in stocks continue, such rebalancing may limit portfolio gains in the near term. Nonetheless, we believe rebalancing remains prudent as part of a disciplined, long-term investment approach.

Fixed Income

Fixed income still appears more fully valued than equities, due to the continuing low interest rate environment. Nevertheless, as part of the rebalancing process, we are modestly increasing exposure to fixed income, where appropriate, to reduce overall portfolio volatility and provide for liquidity needs. In doing so, we continue emphasizing shorter-duration and flexible unconstrained fixed income strategies, which are less sensitive to changes in interest rates since, barring an economic crisis, we expect the Fed to continue normalizing rates.

In Closing

We begin 2018 feeling confident in our positive outlook for the global economy. The United States continues to gradually progress through the business cycle, and tax reform could lead to slightly higher growth in the near term. Europe and Japan are poised for moderate, but stable expansion, and emerging economies should remain robust, led by strength in Asia. Against this backdrop, global corporate profits are expected to continue rising at a healthy rate.

While the economic and earnings environment should remain favorable, several factors could weigh on investment returns in the coming months. Valuations are full, particularly in certain areas of the U.S. equity and fixed income markets, and global liquidity has peaked. In addition, and as discussed in the beginning of this letter, volatility is likely to return to long-term average levels in the future (or higher, as recent days have shown). Any number of developments could trigger its return, and the widespread use of derivatives on volatility can exacerbate its peaks and troughs. Our main concern is that fiscal policy fuels inflation, causing the Fed to accelerate its timetable for monetary tightening, mitigating the effects of tax reform.

As we firmly believe, focusing on your portfolio’s long-term asset allocation provides the strongest antidote to unanticipated events. So, we continue to regularly rebalance portfolios, maintaining broad diversification by asset class, geographic market, asset size, and investment style. In our opinion, broad diversification enhances returns over time, offers the greatest protection against market volatility, and reduces the risk of permanent loss of capital.

Please call us at +1 (301) 881-3727 if you have questions about your portfolio, or if you would like to notify us of any changes in your circumstances.

Sincerely,

The SOL Capital Management Team