Q1 2018 Insights

The first quarter brought a departure from the strong, steady gains in asset prices that investors grew accustomed to in 2017. Most major equity and fixed income indices finished the period with modest declines, and market volatility returned to higher, more normal levels. Factors contributing to the mildly turbulent environment were rising interest rates, concerns about Federal Reserve policy, worries about global trade, as well as a rotation out of certain overvalued technology stocks.

The quarter began on a positive note, with U.S. and international equity markets touching record highs in January and volatility hovering near all-time lows. Economic data was positive, corporate profits were strong (and rising), and investors were feeling optimistic about the U.S. tax cuts. Bond yields were increasing, but this was generally viewed as a reflection of the favorable economic environment.

Sentiment shifted in early February when news of the strongest U.S. wage growth since 2009 fueled expectations that a more proactive Fed might accelerate its timetable for monetary tightening. This belief triggered a global selloff in equities and caused volatility, as measured by the VIX ¹, to surge to levels unseen since 2015 (see Appendix A). Equities recouped a portion of their losses as the quarter progressed, only to weaken again in late March due to escalating trade tensions between the U.S. and China, as well as prospects of increased regulation in the technology sector.

The VIX ended the quarter at 20, in line with its long-term average, but well above its 2017 average of 11. We expect volatility to remain at current normal levels in the months ahead, as major foreign central banks join the Fed in reducing liquidity. Unprecedented quantitative easing has been one of the main reasons for the unusually calm market conditions of the past few years. Therefore, as the global tide of “easy money” recedes (see Appendix B), differentiation between and within asset classes could also become more pronounced. It is in environments like this that we believe active management should thrive.

¹The VIX Index is a measure of market expectations of near-term volatility conveyed by S&P 500 Index option prices.

Financial Markets & Performance

EQUITIES

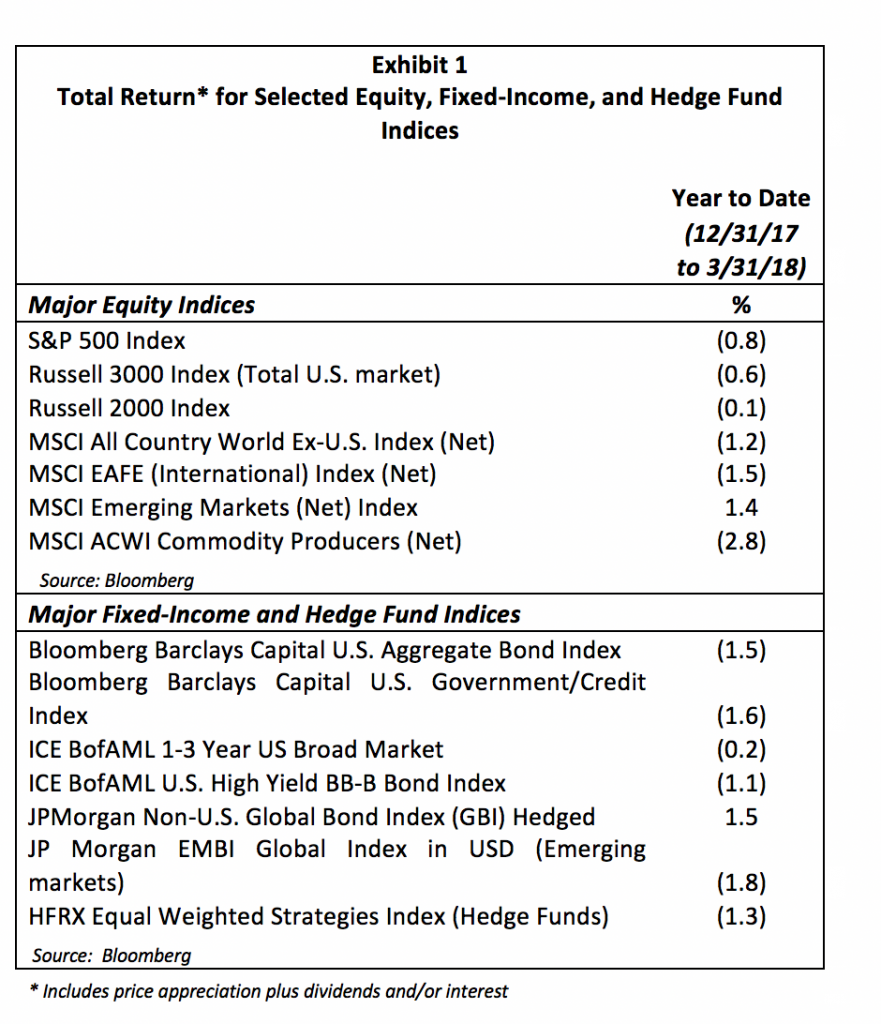

The S&P 500 Index posted its first quarterly loss (see Exhibit 1) since the third quarter of 2015. On a comparative basis, the smallcap Russell 2000 Index was slightly more resilient, as small companies tend to be domestically focused and, therefore, less sensitive to global trade than large companies.

There was significant divergence in style performance in the first quarter, with growth stocks producing solid gains and value stocks declining. It was the fifth consecutive quarter that growth outperformed value across market capitalization segments. Technology was the best-performing sector of the U.S. equity market, while financials generated an essentially flat return. However, they still performed well relative to most other sectors, supported by rising interest rates and financial companies’ generally strong balance sheets. Defensive groups, such as telecommunication services and utilities, continued to lag, suggesting that fundamentals were still driving equity returns.

The performance of international stock markets was mixed. Developed markets finished the quarter modestly lower, as major exporters such as Germany suffered from the threat of a global trade war. Stocks in the U.K. also declined, pressured by continued uncertainty about “Brexit,” Britain’s upcoming departure from the European Union, now just 10 months away. In contrast, emerging markets advanced, lifted by gains in Chinese technology stocks and a strong rally in Brazil, where the economic outlook improved. Across international equity markets, weakness in the U.S. dollar buoyed returns for U.S. dollar-based investors (see Appendix C). The dollar was especially weak versus the yen; consequently, a nearly 5% loss in Japanese equities in yen terms translated into a gain of almost 1% in U.S. dollars.

“There was significant divergence in style performance in the first quarter, with growth stocks producing solid gains and value stocks declining.”

Fixed Income

Concerns that strong economic activity might fuel higher levels of inflation sent long-term Treasury yields higher in January and February, negatively impacting the domestic bond market, despite receding somewhat in March. Short-term yields rose even more, thanks to another 0.25% rate increase by the Fed, as well as heavy Treasury bill issuance, to finance an expanded budget deficit. The outsized increase in short-term rates caused the yield curve to further flatten.

Outside the United States, sovereign yields in developed countries spiked early in the quarter in response to stronger global growth and expectations of higher inflation. Rates subsequently fell amid signs of slowing economic momentum in the eurozone and amid a continuation (for the time being) of accommodative central bank policies. Unlike the U.S. Treasury market, which posted a negative return, government bond markets in developed countries generally finished the quarter in positive territory.

Investment grade corporate issues, which tend to have longer durations, reacted unfavorably to the increases in government bond yields. For the quarter, the performance of investment grade indices in the U.S., the U.K., and the eurozone was negative. High yield bond market returns, while still negative fared better, in part due to their relatively low durations as well as the positive economic and earnings backdrop.

The fundamental backdrop was positive in emerging markets, as evidenced by improving economic growth and benign inflation. However, rising U.S. Treasury yields negatively affected U.S. dollar-denominated debt, both sovereign and corporate. Conversely, investments in local currency bonds benefited from the weaker U.S. dollar.

Global Economic Outlook

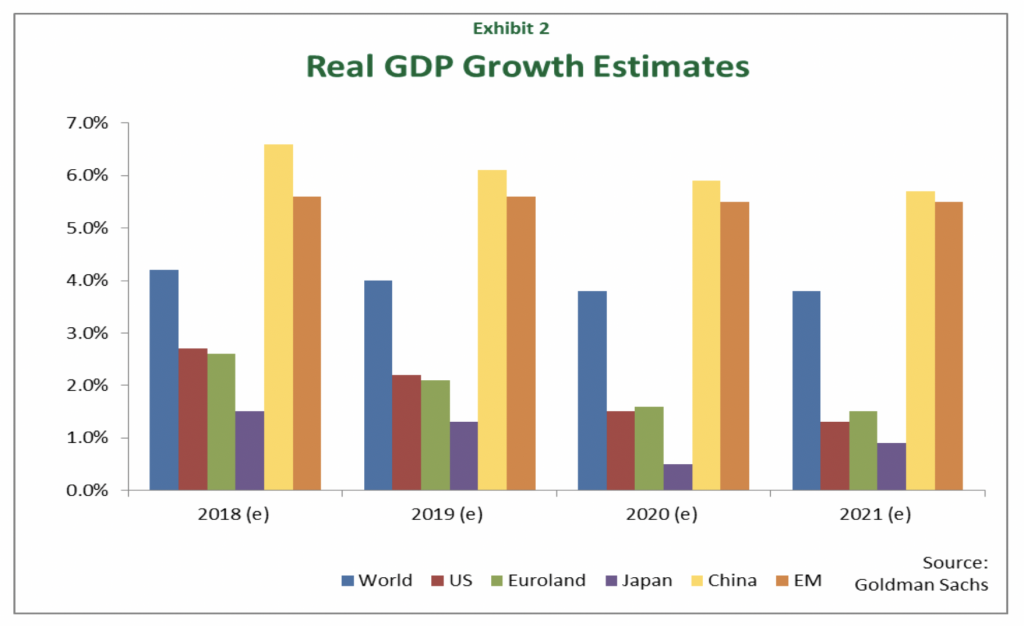

The global economy is expanding at a solid pace, supported by strength in the export and manufacturing sectors (see Appendix D). However, there are signs that global industrial activity may be peaking, including a slowdown in Chinese industrial production and a softening in German business sentiment. Meanwhile, inflation pressures are firming (see Appendix E), which should keep monetary officials moving toward tighter policy. Protectionist U.S. trade policies could pose an additional challenge to the global economy, although the impact is likely to be minimal in the short term. Against this backdrop, global GDP growth is expected to rise from 3.8% in 2017 to over 4% in 2018 and remain stable in subsequent years (see Exhibit 2).

United States

Forecasts suggest that the U.S. economy will grow between 2.7% and 3% in 2018, following 2.3% growth in 2017. The expected acceleration is mainly due to expansionary fiscal policies. The tax bill reduced the corporate tax rate from 35% to 21% and provided an incentive for U.S. multinationals to repatriate offshore profits. These changes will leave many companies with additional spending power, a portion of which they could use on activities that directly benefit the economy, such as making capital investments and increasing wages. Consumers may also choose to spend their extra tax savings, and government expenditures are rising as well; all contributing to GDP growth.

While we expect this fiscal stimulus to boost GDP, we believe the positive effects will not last more than a year or two given that the U.S. economy is in a mature phase of expansion. At this stage in the business cycle, both labor and operating capacity are tight, thereby dampening the impact of tax cuts and higher spending. Moreover, demographics are limiting the economy’s long-term potential since the working-age population is not growing fast enough to sustain higher levels of GDP. Thus, even if capital spending picks up, it is unlikely that the ensuing productivity gains will be sufficient to offset unfavorable demographics.

Another characteristic of late-cycle expansions is heightened uncertainty about the growth outlook for the economy. The flattening of the yield curve has added to this uncertainty by increasing the prospect of a yield curve inversion (i.e., short rates higher than long rates), which has been a harbinger of recession over the past few decades. However, we believe the likelihood of a near-term recession is low, since economic fundamentals are solid, and while inflation has been climbing higher, U.S. dollar weakness and stability in oil prices should help contain inflationary pressures. Furthermore, the Fed’s various Quantitative Easing programs have kept long-term rates artificially low for years, potentially altering the traditional relationship between the slope of the yield curve and the business cycle.

Of course, that dynamic is now changing. The Fed began reducing the size of its balance sheet last October and is expected to continue normalizing interest rates. At its March policy meeting, the central bank maintained its overall forecast of a total of three rate increases for 2018. However, compared to the December meeting, a greater number of Fed officials projected at least four total rate hikes for the year.

Europe and Japan

Overseas, the eurozone is experiencing a mid-cycle expansion. Domestic consumption is accelerating, unemployment is declining, and pent-up demand for housing is contributing to strong credit growth. Some recent softness in economic data, including the previously mentioned slump in German business confidence, suggests that the region’s economy may be losing some of its dynamism after having grown at its fastest pace in a decade last year. Nonetheless, the eurozone appears poised for healthy growth, and the European Central Bank could begin phasing out its bond-buying program by the end of 2018.

The U.K. and Japanese economies are forecast to grow this year, although at modest rates that will continue to lag many other developed economies. Despite similar expected growth rates for 2018, the two countries are at very different stages in the business cycle. Nearly two years since the Brexit referendum, the U.K. remains in the late phase of expansion, with slowing growth and elevated inflation. In contrast, Japan is in the early part of the cycle, with solid exports to the United States and China, and low unemployment, paving the way for wage growth. In February, core inflation reached 1% for the first time since 2014. While the uptick in price pressures is still well below the Bank of Japan’s 2% target, it has fueled speculation that the central bank might soon start reining in stimulus.

Emerging Markets

Developing countries remain on track to continue growing at much faster rates than their developed counterparts. The outlook is particularly bright for India, whose economy surpassed Chinese growth in the fourth quarter of last year and is supported by higher levels of government infrastructure spending. China’s economy appears to be slowing, as policymakers have tightened financial conditions to address excess borrowing and overcapacity in the industrial sector. However, growth is still expected to be strong, driven by domestic consumption.

In Latin America, Brazil is in the early stages of recovery, and what seems to be a sluggish start to the year will likely give way to stronger growth as 2018 unfolds, bolstered by monetary easing. Mexico’s economy is healthy; the manufacturing sector is expanding, and the new central bank governor appears committed to controlling inflation. However, consumer and business confidence has fallen, reflecting the unsettled political climate. Although an agreement on NAFTA seems imminent, the country’s general election in July could result in a protectionist administration. Brazil’s presidential election is only three months later, and the imprisonment of former President Lula da Silva has blown the race wide open.

Investment Strategy

Equities

The combination of higher expected profits and lower stock prices has pushed U.S. equity valuations back toward their long-term average (see Appendix F). Despite lower valuations in the United States, international stocks still appear more attractively valued (see Appendix G). Therefore, we continue to tactically overweight non-U.S. equities, where appropriate.

The current market volatility is providing our active managers with more opportunities to buy high-quality stocks at attractive prices. As monetary stimulus is gradually removed, sectors and individual securities are beginning to behave differently, rather than moving in tandem. Our fund managers are identifying more opportunities within the U.S. market than we have in quite a while. Where appropriate, we continue to gradually reduce exposure to areas of the market that have performed exceptionally well, such as some growth stocks.

Fixed Income

Fixed income still appears more fully valued than equities since, although interest rates have risen, they remain low by historical standards. That said, as we rebalance portfolios, we are modestly increasing fixed income exposure back to target, where appropriate, to dampen overall portfolio volatility and provide for liquidity needs. As part of the rebalancing process, we continue emphasizing shorter-duration and flexible, unconstrained fixed income strategies, which are less sensitive to movements in interest rates. We believe this is a prudent approach to managing fixed income exposure because, barring an economic crisis, we expect the Fed to continue raising interest rates and unwinding its balance sheet.

In Closing

Volatility has returned to the global financial markets, and we expect these normal levels of volatility to continue in the coming quarters, driven primarily by monetary (e.g. central bank tightening) and political developments (e.g. trade negotiations and elections). However, it is important to remember that the removal of liquidity and gradual interest rate hikes are reflections of economic strength. The synchronized global expansion remains on track and the outlook for corporate profits is strong, creating a supportive backdrop for financial markets.

As always, we remain committed to meeting your long-term investment goals, within your risk profile, and funding your future liquidity requirements. Please call us at +1 (301) 881-3727 to update us on any changes in your personal circumstances or if you have questions about your portfolio.

Sincerely,

The SOL Capital Management Team