What does the Ukraine crisis mean for your portfolio?

The Russian invasion of Ukraine has been dominating headline news for weeks now. First and foremost, our thoughts are with the Ukrainian people as well as those in Russia that oppose such military action. We, like many, have been stunned by the horrifying scenes of death and destruction, and it’s been especially heartbreaking to see the toll the war has taken on innocent civilians.

The Russian invasion of Ukraine has been dominating headline news for weeks now. First and foremost, our thoughts are with the Ukrainian people as well as those in Russia that oppose such military action. We, like many, have been stunned by the horrifying scenes of death and destruction, and it’s been especially heartbreaking to see the toll the war has taken on innocent civilians.

As the world watches to see if tensions will further escalate or diffuse, many investors are concerned about the impact on their portfolios. To help our clients navigate the markets, we, the Client Relationship Managers, sat down with SOL Capital Portfolio Manager Adam Sauri, CFA, to get his perspective on the Ukraine crisis and guidance for investing during these turbulent times. In this Q&A, Adam will address three key questions we’ve been hearing from our clients.

As the world watches to see if tensions will further escalate or diffuse, many investors are concerned about the impact on their portfolios. To help our clients navigate the markets, we, the Client Relationship Managers, sat down with SOL Capital Portfolio Manager Adam Sauri, CFA, to get his perspective on the Ukraine crisis and guidance for investing during these turbulent times. In this Q&A, Adam will address three key questions we’ve been hearing from our clients.

Question #1: What is the exposure to Russia in our client portfolios?

Direct exposure to Russia (and Ukraine, for that matter) was minimal in our clients’ portfolios leading up to the current crisis. For starters, Russia was not a major constituent of global equity or fixed income indices. Moreover, most of the investment managers we select have exercised considerable care and diligence in monitoring the geopolitical instability surrounding NATO-Russia relations, political risk, and corruption concerns. As a result, they have been actively underweighting Russian holdings for years before the invasion of Ukraine. Of course, there is also indirect exposure through multinational firms that are now incurring costs by shuttering their operations in Russia or by facing a probable default on payments. However, given the relative size of these revenues in their global operations, we are less concerned about severe financial contagion in client portfolios.

That said, as we continue to monitor how the markets react to the Russia-Ukraine war, we will adapt our client portfolios as needed — especially if we foresee significant changes in capital market expectations. However, in light of our limited exposure to Russian investments, we remain committed to our long-term investment selection and strategic allocation decisions for our clients. We firmly believe our core principle of diversification will continue to play a critical role in reducing portfolio volatility from geopolitical events such as this one.

Question #2: How should investors think about the potential impact of global markets currently and in the future?

Geopolitical risk and uncertainty typically amplify volatility and trigger temporary “flights to safety.” This time is no different, and we anticipate volatility to remain heightened as Russia-Ukraine tensions and knock-on economic effects unfold over the short term. It’s important to keep in mind how quickly things are changing. New information, battlefield developments, and retaliatory sanctions are surfacing in real time, which can dramatically change the course of financial markets. As new information emerges, we believe market sentiments will oscillate between risk-off and risk-on. Thus, we want to avoid making rash decisions when markets are already hyper-sensitive and investor stress is high.

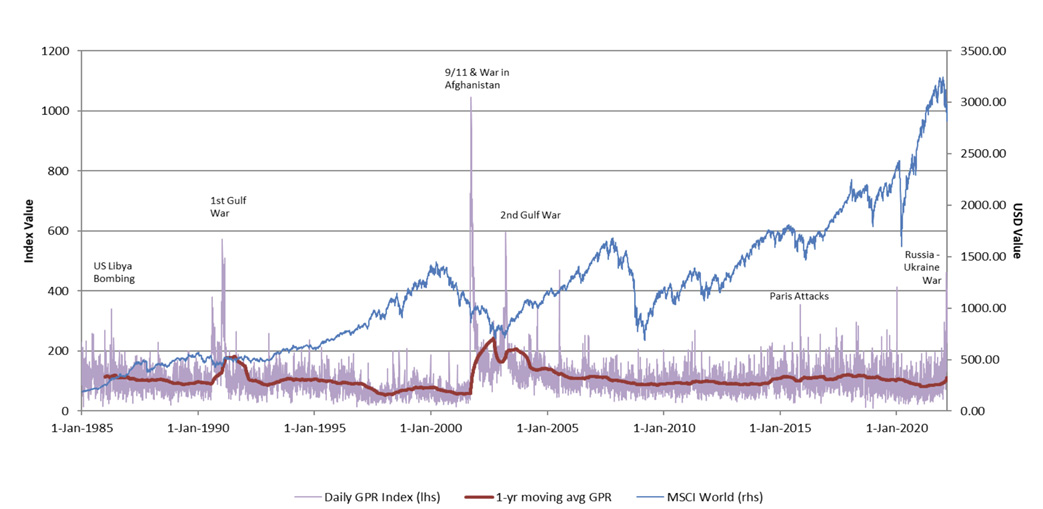

Moving to a longer-term perspective, it can be helpful to examine past events to see why it’s best to simply stay the course through geopolitical volatility and remain invested. The chart below looks at a measure of geopolitical risk over the past 30+ years alongside the performance of global equities, represented here with the MSCI World Index. There are two key takeaways for investors in the data. First, we’re not yet experiencing the same levels of geopolitical risk (as measured by Dr. Iacoviello’s methodology) compared to previous events such as the Gulf wars and 9/11 attacks. More importantly, those events did not prevent equities from moving higher over the medium term or hinder a recovery. It’s worth emphasizing that the drivers of long-term equity returns (and short-term corrections) are often tied to other factors such as the trajectory of economic growth, technological advances, relative valuations, financial leverage, interest rates, and global health crises, rather than geopolitical events.

Historical Geopolitical Risk Index vs. MSCI World Index 1985-2022

Source: State Street Global Advisors (SSGA) Research using GPR index data created by Matteo Iacoviello, an economist and Deputy Associate Director at the Federal Reserve Board (https://www.matteoiacoviello.com), and MSCI World Index data from Bloomberg. Data as of 7 March 2022. Past performance is not a guarantee of future results.

Looking ahead, we think inflation concerns and interest rate hikes will still be a pervasive theme. Sanctions on the Russian energy sector and the disruption of normal trade in other agricultural products and industrial metals have roiled commodity markets. As a result, elevated inflation is being further stoked, increasing the headwinds for economic growth. However, even before the Russia-Ukraine war, we’ve been working to adapt our clients’ portfolios for higher inflation and have been managing expectations regarding future returns. Despite our forecast for heightened volatility and lower global growth, we still expect equities to outperform bonds in the long run and believe diversified global equity exposure will continue to play a critical role in portfolios for long-term investors.

Question #3: What should investors do to protect their portfolios while participating in the markets?

The greatest risk for investors stemming from a market crisis is often overreacting and/or under-diversifying. This was true of past geopolitical events and was once again proven true during the pandemic. Global indices took a historic plunge in March 2020, but by the end of the year, equity markets had bounced back stronger than ever and, for investors that had stayed the course, their portfolios had more than recovered the declines witnessed earlier in the year. This example is yet another cautionary tale for investors who are tempted to pull out of the market at the height of volatility only to miss out on the upswing.

As financial markets whipsaw depending on the latest Russia-Ukraine developments, investors would be wise to remain invested and not attempt to time the market. Although it’s been painful to see negative year-to-date returns in 2022, we should remember they are pulling back from a stellar 2021 and avoid overreacting. When investors sell at the wrong time and miss out on subsequent market recoveries, it can permanently damage portfolios and erode wealth. To prevent this misstep, we encourage investors to refocus on things that truly matter such as economic fundamentals, global growth opportunities, maintaining proper diversification, and long-term investment goals. At SOL Capital, we focus on what we believe adds value for our clients over the long term, including:

- Systematically rebalancing portfolios. Not only does rebalancing allow us to realign our client portfolios back to their original asset allocation targets, but it also helps us take advantage of short-term market dislocations and add value by enforcing the principle of buying low and selling high. For example, rebalancing during this volatile period has allowed us to move from bond funds — which have fared better — into equities that have been under pressure. In addition, we’ve trimmed back on a few sectors or styles that have outperformed, such as energy, natural resources, commodities, and value names. We then reinvest those proceeds into sectors or regions that have become more attractive on a valuation basis, such as growth and international equities.

- Increasing portfolio protection. While no single approach works for every investor, there are a few ways to de-risk one’s portfolio if necessary. This may include rebalancing and trimming outperformers, as previously mentioned, overweighting strategies with a higher quality focus, and/or increasing exposure to shorter-duration bond strategies. However, before making adjustments that can alter the portfolio’s trajectory, it’s critical to have a transparent and honest conversation with our clients. This helps us better understand if the desire to add protection is stemming from anxiety due to volatility or in order to address unforeseen liquidity needs. Again, we want to help our clients avoid making mistakes that may derail them from their longer-term goals.

Investing can be an emotional endeavor, especially during volatile and challenging times. At SOL Capital, we seek to help our clients make investment decisions with a clear head by focusing on economic fundamentals, current valuations, and long-term expected returns, while avoiding short-term, emotional decision making. We encourage investors to remain calm, stay the course, and reach out to us if there are any doubts or questions.

Please remember to contact SOL Capital in writing if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us in writing to the contrary, we shall continue to provide services as we do currently.

Interested in having a more personalized conversation about navigating the markets for your financial situation?